Notwithstanding the franking debate last year, ASX hybrids were the second-best performing asset-class behind long-dated government bonds in 2018 with an attractive 4.9% gross return, smashing the AusBond Floating-Rate Note Index (2.3%) and the Aussie equities market including dividends (down -3.5%).

Major bank hybrids are rated by S&P at BB+, which is technically in the so-called “high yield” or sub-investment grade category. Up until May 2017 they were, in fact, rated BBB-, which placed them in the “investment-grade” band, but a downgrade of Australia’s economic risk score by S&P saw both Tier 2 bonds and Additional Tier 1 (AT1) capital hybrids notched down to BBB and BB+, respectively.

We are of the view that S&P will likely upgrade these securities to their pre-May 2017 levels because it has recently put Australia’s economic risk score on trend for an improvement back to its April 2017 mark as our housing imbalances unwind and the federal budget moves back into balance.

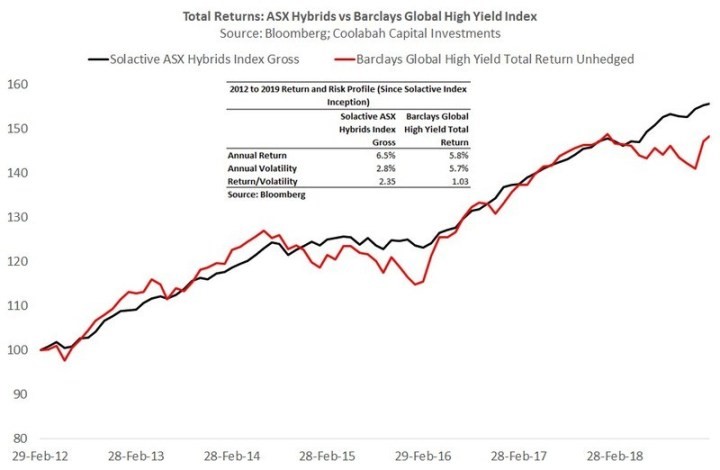

Nevertheless, since hybrids are technically rated as high yield, this begs the question: how have they have performed compared to the global high yield market? To answer this we use the benchmark Bloomberg Barclays Global High Yield Total Return Index in unhedged form.

It is important to examine returns on an unhedged basis because currency hedging can drive dramatically different results depending on the currency you use. Historically hedging US dollar assets into Aussie dollars has, for example, artificially increased your returns by about 4% annually over the last couple of decades (and more than 2% per annum over the past 7 years) according to CBA’s research. This is because Australia has over this period had a much higher cash rate than the US. The average RBA cash rate since 1999 has been 4.1% compared to a 1.8% average Fed funds rate. Since, however, the Fed funds rate, which is currently 2.5%, has risen above the RBA cash rate (1.5%), hedging US assets into Aussie dollars has reduced, not increased, returns.

Put differently, you could mislead investors if you presented US high yield returns hedged into Aussie dollars as the basis for future return expectations if you believe that short-term cash rates in Australia will continue to remain well below equivalent US rates, which is certainly the current market consensus.

Given this, I simply focus on the unhedged returns of each asset-class to enable a true like-for-like comparison of how hybrids and high yield have historically performed before considering exogeneous factors like currencies.

I use the Solactive ASX Hybrids Index, which is the only independently produced index that exists. It starts in early 2012, which gives us a decent seven year timeframe with which to compare the risk and return profiles of these alternatives. Importantly, this period covers some big shocks for both hybrids and high yield, including 2012, 2015, early 2016, and again 2018.

A few things stand out. First, the correlation between ASX hybrids and global high yield is reasonably strong at 0.52 over the last seven years. Second, ASX hybrids have clearly much lower risk, with annual return volatility of 2.8% compared to high yield’s 5.7%. That is, hybrids have about half the risk of high yield. This is not surprising given that most of these hybrids are rated BB+ and very close to being investment grade whereas the global high yield index credit rating is on average three notches lower at B+. This was also true during the GFC when peak-to-trough losses on across the ASX hybrids market were lower than the global high yield index.

The final observation relates to the returns. The ASX hybrids market has returned 6.5% annually gross over the last 7 years compared to the global high yield market’s 5.8%. If we divide the hybrid market’s return by its volatility, the risk-adjusted return ratio of 2.35 times is also much higher than the 1 times ratio for high yield.

The much higher risk in high yield is also being driven by the fact that these assets are typically fixed-rate bonds rather than floating-rate. In Australia, the fixed-rate AusBond Composite Bond Index has historically had about 10 times higher volatility than the floating-rate AusBond FRN Index purely as a function of interest rate risk. Almost all ASX hybrids are, by way of contrast to high yield, floating-rate.

While hedging into Aussie dollars has historically made a massive difference, lifting the high yield index returns by 2.1% annually, this is not likely to be true going forward. Currently, hedging US dollar assets into Aussie dollars is reducing, rather than increasing, returns because the Fed funds rate has lifted so far above the RBA’s cash rate.

Some folks have been trying to encourage investors to shift out of hybrids into high yield because of concerns about non-taxpayers’ ability to claim cash refunds from the ATO on franking credits. North of 90% of all current investors who do pay tax will be able to continue to claim franking credits under Labor. And if Labor wins, it is plausible that the Senate will seriously dilute or block the policy entirely. So if you are thinking of switching, you need to consider several important risks.

The first is that ASX hybrids typically have much better credit ratings than global high yield and have historically displayed markedly lower probabilities of loss. As one example, the BB- average rating on the NB Global Corporate Income Trust (ASX: NBI) is several notches below major bank hybrids.

A second consideration is that retail investors are generally familiar with the Australian banks and insurers that dominate the ASX hybrids market. They will not be nearly as conversant with the hundreds of smaller companies that typically populate a high yield portfolio and which generally carry much higher probabilities of default and loss.

A third very important factor is that if you are evaluating historical US high yield returns hedged into Aussie dollars, the track-record has been boosted by about 2% to 4% annually simply through the entirely coincidental benefits of currency hedging. Today this historical tail-wind has completely disappeared and transformed into a return headwind. Accordingly, one should first evaluate the unhedged returns on the assets in question, and then consider whether hedging will be an opportunity or cost.