USD Strategies

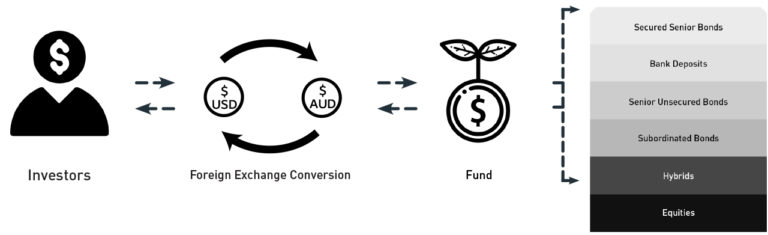

CCI offers Australian based investors with US dollars access to the Australian fixed income market through a Smarter Money and Long-Short Strategy. These solutions target returns between 1.5% and 3%, and 4% and 6% above the US Federal Funds Target Range.

Coolabah Short Term Income Fund

USD Cash Plus 1.5% to 3.0% pa Strategy

The Coolabah Short Term Income USD strategy is a zero duration, short-term fixed-interest investment solution that targets returns that outperform the US Federal Funds Target Range by 1.5% to 3.0% per annum after all fees, over rolling 12 month periods.

This strategy gains exposure to an actively managed portfolio of Australian cash securities and investment-grade floating-rate notes with a target dollar-weighted average credit rating in the “A” band hedged to US dollars. It does not invest in fixed-rate bonds (unless interest rate risk is swapped out) or equities.

The portfolio managers add value through active asset-selection with materially lower volatility and interest rate duration risk than traditional fixed interest funds.

Smarter Money Long-Short Credit Fund

USD Cash Plus 4.0% to 6.0% pa Strategy

The Smarter Money Long-Short Credit USD strategy provides investors with US dollars exposure to an absolute return fixed-income strategy focused on exploiting long and short mispricings in credit markets.

The USD strategy targets returns above the US Federal Funds Target Range plus 4% to 6% pa over rolling 3 year periods after Management Fees, Administration Fees and Performance Fees. It targets volatility of less than 5% pa.

This strategy offers investor exposure primarily to senior and subordinated bonds, hybrids and derivatives, hedged to US dollars. The Smarter Money Long-Short Credit Fund targets holding the majority of its portfolio in investment-grade quality debt securities.

The strategy aims to generate high absolute returns that have low-to-no correlation with equities, fixed-rate bonds and property markets, from relatively low risk and liquid investments identified through the portfolio managers’ proven active asset-selection process. The strategy aims to reliably distribute strong quarterly income.

The portfolio managers seek to generate these returns by taking “long” or “short” positions in relation to assets which they consider are trading below or above fair value. The goal is to generate significant risk-adjusted returns, or “alpha”. The ability to go long or short, either directly or through using derivatives, means it can profit from bond price rises and price falls. Going long or short can also result in the strategy being leveraged.

Key Facts

| Name | Smarter Money Higher Income Fund | Smarter Money Long-Short Credit Fund |

|---|---|---|

| Class | USD Investor | USD Investor |

| ARSN | 601 093 485 | 617 838 543 |

| Investment Objective | Targets returns in excess of the midpoint of the US Federal Fund Target Range plus 1.5% to 3.0% pa after Management Costs | Targets returns in excess of the midpoint of the US Federal Fund Target Range plus 4.0% to 6.0% after Management Costs |

| Distribution Frequency | Quarterly | Quarterly |

| Distribution Method | Reinvestment or paid out | Reinvestment or paid out |

| Issuer & Responsible Entity | Equity Trustees | Equity Trustees |

| Investment Manager | Coolabah Capital Investments (Retail) | Coolabah Capital Investments (Retail) |

| Fund Administrator | Mainstream Fund Services | Mainstream Fund Services |

| Registry | Mainstream Fund Services | Mainstream Fund Services |

| Custodian | Mainstream Fund Services | Mainstream Fund Services |

| Auditor | Ersnt & Young | Ersnt & Young |

Pricing Information

| Name | Smarter Money Higher Income Fund | Smarter Money Long-Short Credit Fund |

| Class | USD Investor | USD Investor |

| APIR Code | ETL3997AU | ETL7843AU |

| ISIN | AU60ETL39970 | AU60ETL78432 |

| Management Costs | 0.55% pa | 0.75% pa |

| Performance Fee (%) | 22.5% of excess fund performance over the Benchmark, subject to a high water mark | 20.5% of excess fund performance over the Benchmark, subject to a high water mark |

| Benchmark | Midpoint of the US Federal Fund Target Range plus 1.5% pa plus Management Costs" | Midpoint of the US Federal Fund Target Range plus Management Costs |

| Minimum Investment | $1,000 USD | $1,000 USD |

| Additional Investment | $1,000 USD | $1,000 USD |

| Minimum Balance | $1,000 USD | $1,000 USD |

| Saving Plan | N/A | N/A |

| Savings Plan Minimum | N/A | N/A |

| Buy Spread | 0.000% | 0.000% |

| Sell Spread* | 0.025% | 0.050% |

Resources

From 5 October 2021, a Target Market Determination (TMD) is required to be made available under the Design & Distribution Obligations. It describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. It also describes the events or circumstances where the Target Market Determination for this financial product may need to be reviewed.

*The Buy Sell Spread may change depending on the transaction costs associated with buying and selling the assets within the Fund’s portfolio at that time. Any changes to the spreads after the date of the PDS will be published here.

Disclaimer: Past performance does not assure future returns. Returns are shown after all fund fees, unless otherwise stated. Retail product fees can vary depending on the unit class selected and/or whether the financial advisory firm has negotiated access to lower cost unit classes.

Equity Trustees Limited (Equity Trustees) ABN 46 004 031 298 AFSL 240975, is the responsible entity for the Smarter Money Fund (SMF), the Coolabah Short Term Income Fund (STIF), Smarter Money Long-Short Credit Fund (LSCF), Coolabah Long-Short Opportunities Fund (LSOP), the Coolabah Floating-Rate High Yield Fund (Managed Fund) (YLD) and the Coolabah Active Composite Bond Fund (Hedge Fund) (Ticker: FIXD). Equity Trustees is a subsidiary of EQT Holdings Limited ABN 22 607 797 615, a publicly listed company on the Australian Securities Exchange (ASX: EQT).

This has been prepared by Coolabah Capital Investments (Retail) Pty Ltd ACN 153 555 867 (Coolabah), an authorised representative (#000414337) of Coolabah Capital Institutional Investments Pty Ltd ABN 85 605 806 059 AFSL 482238, to provide you with general information only. In preparing this publication, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. The Product Disclosure Statement (PDS) for the Fund should be considered before deciding whether to acquire or hold units in it. A PDS for the Fund can be obtained by visiting www.coolabahcapital.com. Neither Coolabah, Equity Trustees nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. The Fund is subject to investment risks, which could include delays in repayment and/or loss of income and capital invested.

CONTACT US TODAY

SYDNEY

Level 3, 1 Bligh Street, Sydney NSW 2000

MELBOURNE

Level 38, South Tower, 80 Collins Street, Melbourne VIC 3000

LONDON

Second Floor, 28 Austin Friars, London EC2N 2QQ