Global Floating-Rate High Yield Strategy

A global floating-rate portfolio of investment grade bonds & hybrids with enhanced yields

Currently yielding

7.1% p.a.

before fees as of 30-May-2025

Coolabah Global Floating-Rate High Yield Fund

INVESTMENT GRADE, HIGH YIELDING, SHORT DURATION STRATEGY

Overview

The Coolabah Global Floating-Rate High Yield Fund focusses on generating higher income than other traditional fixed income investments by investing in a floating-rate portfolio of investment-grade bonds and hybrid securities issued predominately by global banks and insurers and enhancing the yields (or interest-rate) through the use of gearing (or leverage).

| YLDX | Major Bank Hybrids | |

|---|---|---|

| Avg Credit Rating | A+ | BBB |

| Gross Running Yield | 7.1% | 6.9% |

| Liquidity | Daily redemption rights | ASX hybrid liquidity |

| Senior/Tier 2/Hybrid Portfolio Weight | 226% / 89% / 0% | 0% / 0% / 100% |

| Market Size | $29 trillion | $45 billion |

| No. Securities in Universe | > 60,000 | 21 |

Disclaimer: The yield displayed for the Coolabah Global Floating-Rate High Yield Fund is the annual running yield before fees. The yield shown changes daily and may be different on the day you invest. All investments carry risks, including that the value of investments may vary, future returns may differ from past returns, and that your capital is not guaranteed. The Fund has a different risk profile to the other comparisons, including, amongst other things, that it uses leverage, which means that both gains and losses may be amplified. To understand the Fund’s risks better, please refer to the Product Disclosure Statement.

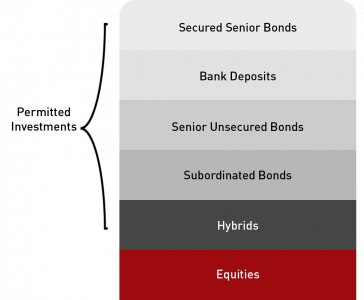

Investments

The Fund invests in a portfolio of investment grade senior and Tier 2 bonds and cash securities issued in G10 currencies by bank and insurers. It has the capacity to invest in government bonds, corporate bonds and hybrid securities.

The Fund targets an interest rate duration exposure of less than 3 months by investing primarily in short-term deposits and floating-rate debt securities, also known as ‘Floating-Rate Notes’ (“FRNs”) or ‘Floating-Rate Bonds’. FRNS are a type of bond that pay an interest (or coupon) rate which moves up and down with changes in a recognised reference interest rate. The interest (or coupon) rate is the sum of the reference rate and a spread or margin. In Australia, they generally track the returns of the RBA’s cash rate plus a spread or margin and generally have a low or near-zero interest rate risk.

The Fund may also invest in fixed-rate bonds with maturities greater than 12 months provided the interest rate is hedged to floating.

Coolabah applies bottom-up and top-down fundamental analysis of both issuers of the securities and the credit quality and structural features of the securities themselves to build a portfolio of global cash and debt investments that offer attractive yields whilst minimising the risk of capital loss.

The Fund does not invest in equities, property, sub-investment grade debt or private credit.

The Fund is permitted to use leverage.

Risks

The Fund is not a bank deposit.

It is a managed investment scheme registered and regulated by the Australian Securities and Investments Commission (ASIC).

All investments carry risks, including that the value of investments may vary, future returns may differ from past returns, and that your capital is not guaranteed. The Fund can borrow and use derivatives, meaning the Fund is geared (or leveraged). Leverage can amplify gains and also amplify losses.

To understand the Fund’s risks better, please refer to the detailed “Risks” section in the PDS and to the Fund’s Target Market Determination (TMD)^.

Ratings

Qualitative

The Coolabah Global Floating-Rate High Yield Fund aims to generate higher income than other traditional fixed income investments by investing in a floating-rate portfolio of investment-grade bonds and hybrid securities issued predominately by global banks and insurers and enhancing the yields (or interest-rate) through the use of gearing (or leverage).

The Fund invests in a portfolio of investment grade senior and Tier 2 bonds and cash securities issued in G10 currencies by bank and insurers. It has the capacity to invest in government bonds, corporate bonds and hybrid securities.

The Fund targets an interest rate duration exposure of less than 3 months by investing primarily in short-term deposits and floating-rate debt securities, also known as ‘Floating-Rate Notes’ (“FRNs”) or ‘Floating-Rate Bonds’. FRNS are a type of bond that pay an interest (or coupon) rate which moves up and down with changes in a recognised reference interest rate. The interest (or coupon) rate is the sum of the reference rate and a spread or margin. In Australia, they generally track the returns of the RBA’s cash rate plus a spread or margin and generally have a low or near-zero interest rate risk.

The Fund may also invest in fixed-rate bonds with maturities greater than 12 months provided the interest rate is hedged to floating.

Coolabah applies bottom-up and top-down fundamental analysis of both issuers of the securities and the credit quality and structural features of the securities themselves to build a portfolio of global cash and debt investments that offer attractive yields whilst minimising the risk of capital loss.

The Fund does not invest in equities, property, sub-investment grade debt or private credit.

The Fund is permitted to use leverage.

The Fund is not a bank deposit.

It is a managed investment scheme registered and regulated by the Australian Securities and Investments Commission (ASIC).

All investments carry risks, including that the value of investments may vary, future returns may differ from past returns, and that your capital is not guaranteed. The Fund can borrow and use derivatives, meaning the Fund is geared (or leveraged). Leverage can amplify gains and also amplify losses.

To understand the Fund’s risks better, please refer to the detailed “Risks” section in the PDS and to the Fund’s Target Market Determination (TMD)^.

The Fund is rated ‘Recommended’ by Lonsec and Zenith Investment Partners.

Key Facts

| Name | Coolabah Global Floating-Rate High Yield Fund |

|---|---|

| ARSN | 682 667 072 |

| Investment Objective | The investment objective of the Fund is to provide investors with exposure to a global floating-rate portfolio of investment-grade bonds and hybrid securities with enhanced yields |

| Inception Date | 17-Feb-2025 |

| Applications | Daily |

| Withdrawals Daily | (T+3) |

| Distribution Frequency | Monthly |

| Distribution Method | Reinvestment or paid out available |

| Issuer & Responsible Entity | Equity Trustees |

| Investment Manager | Coolabah Capital Investments (Retail) |

| Fund Administrator | Apex Fund Services |

| Registry | Apex Fund Services |

| Custodian | Citigroup |

| Auditor | Ernst & Young |

Pricing Information

| Class | Assisted Investor Class |

| APIR Code | ETL6322AU |

| ISIN | AU60ETL63228 |

| Tradable | Directly with the Responsible Entity |

| Management Costs | 1.00% p.a. |

| Performance Fee (%) | None |

| Benchmark | Bloomberg AusBond Credit FRN 0+ Yr Index (BAFRN0) |

| Minimum Investment | $1,000 |

| Additional Investment | $1,000 |

| Minimum Balance | $1,000 |

| Buy Spread | 0.00% |

| Sell Spread* | 0.05% |

Distributions

Distribution Per Unit ($)

| Month Ending | Assisted Investor Class | Institutional Class |

|---|---|---|

| APIR Code | ETL6322AU | ETL2021AU |

| 30-May-2025 | 0.054 | 0.054 |

| 30-Apr-2025 | 0.06 | 0.06 |

| 31-Mar-2025 | 0.06 | 0.06 |

Platform Availability

| Platform | Assisted Investor Class |

|---|---|

| APIR Code | ETL6322AU |

| ASX/Cboe | No |

| Acclaim Invest | No |

| Acclaim Super | No |

| AMP North | No |

| Australian Money Market | No |

| Beacon | No |

| BT Asgard | No |

| BT Panorama | No |

| CFS Edge | No |

| CFS FirstWrap | No |

| Credit Suisse | No |

| Crestone | No |

| Diversa | No |

| Hub24 | Yes |

| IOOF Pursuit | No |

| Key Invest | No |

| Macquarie Wrap | No |

| mFunds | No |

| Mason Stevens | No |

| MLC Navigator | No |

| MLC Wrap | No |

| Morgan Stanley | No |

| Netwealth | No |

| OneVue | No |

| Perpetual WealthFocus | No |

| Powerwrap | No |

| Praemium | No |

| Stropro | No |

| UBS | No |

| uXchange | No |

| Wilsons Advisory | No |

Resources

Research Reports

- Foresight Analytics

- Lonsec (Contact Us)

- SQM Research (Contact Us)

- Zenith (Contact Us)

Frequently Asked Questions

Complete a withdrawal request form and submit it to the responsible entity (RE). Further instructions are on the form.

^From 5 October 2021, a Target Market Determination (TMD) is required to be made available under the Design & Distribution Obligations. It describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. It also describes the events or circumstances where the Target Market Determination for this financial product may need to be reviewed.

*The Buy Sell Spread may change depending on the transaction costs associated with buying and selling the assets within the Fund’s portfolio at that time. Any changes to the spreads after the date of the PDS will be published here.

Disclaimer: Past performance does not assure future returns. Returns are shown after all fund fees, unless otherwise stated. Retail product fees can vary depending on the unit class selected and/or whether the financial advisory firm has negotiated access to lower cost unit classes.

Equity Trustees Limited (Equity Trustees) ABN 46 004 031 298 AFSL 240975, is the responsible entity for the Fund. Equity Trustees is a subsidiary of EQT Holdings Limited ABN 22 607 797 615, a publicly listed company on the Australian Securities Exchange (ASX: EQT).

This has been prepared by Coolabah Capital Investments (Retail) Pty Ltd ACN 153 555 867 (Coolabah), an authorised representative (#000414337) of Coolabah Capital Institutional Investments Pty Ltd ABN 85 605 806 059 AFSL 482238, to provide you with general information only. In preparing this publication, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. The Product Disclosure Statement (PDS) for the Fund should be considered before deciding whether to acquire or hold units in it. A PDS for the Fund can be obtained by visiting www.coolabahcapital.com. Neither Coolabah, Equity Trustees nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. The Fund is subject to investment risks, which could include delays in repayment and/or loss of income and capital invested.

Ratings & Research Disclaimers

Lonsec Research

The rating issued 06/2025 ETL6322AU is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2025 Lonsec. All rights reserved.

Zenith

The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (assigned ETL6322AU May 2025) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at Fund Research Regulatory Guidelines.

- MANAGED FUNDS

- Smarter Money Fund

- Coolabah Short Term Income Fund

- Coolabah Floating-Rate High Yield Fund

- Coolabah Global Floating-Rate High Yield Fund

- Smarter Money Long-Short Credit Fund

- Coolabah Long-Short Opportunities Fund

- Coolabah Active Composite Bond Complex ETF

- Coolabah Active Global Bond Fund

- Coolabah Active Sovereign Bond Strategy

- USD Strategies