Today I write that the ACCC inquiry into the big banks, and the front book/back book fracas that reportedly precipitated it, are completely bogus. Let’s get a few facts straight. First, all businesses, including banks, are free to discount new product sales. Trying to prevent banks from doing so would be akin to telling Coles they cannot offer cheaper products to customers because it would be unfair on those who previously paid higher prices. The market, not regulators, should determine clearing prices and if bank customers think rates are too high, they are free to vote with their feet and tap lower rates elsewhere. Second, the four major banks have never faced more competition, nor been at a greater regulatory disadvantage to their peers. They are far and away the most heavily regulated, and hence constrained, businesses in Australia. They even pay over one billion dollars each year in a unique “big bank tax” that Prime Minister Scott Morrison introduced to force them to compensate taxpayers for the cost of funding subsidies they garner from being too-big-to-fail (this is the major bank levy of 0.06 per cent annually on the value of all their wholesale liabilities). To read the full column, click here or AFR subs can click here. Excerpt only:

In late 2015 this column prophesied that as the major banks were being forced to radically reduce their balance-sheet leverage, which we had long advocated, their returns on equity (RoE) would inevitably “converge with their 11 per cent cost of equity, which will push valuations down from 2 to 3 times book value to 1 to 2 times”. If a bank’s RoE is equal to its cost of equity, it should theoretically trade at book value.

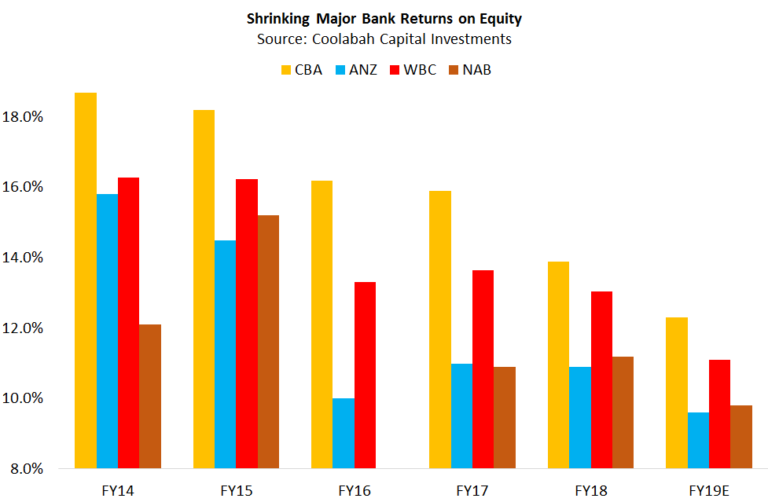

A few months prior CBA had reported a world-beating full year statutory (ie, real) RoE of 18.7 per cent and had been trading as high as 3 times book value. Westpac and ANZ were not far behind with RoEs around 16 per cent, and traded at 2.5 times and 2 times book value, respectively. The one (consistent) laggard was NAB, lodging a comparatively miserly RoE of 12.1 per cent, although it still traded at close to 2 times book value in 2015.

The major banks were the most profitable retail deposit-takers on earth, and their valuations reflected it. But as I explained in a letter to Warren Buffett, this profitability was an artefact of leverage. The majors’ return on assets were actually ordinary and inferior to the best US banks. And once policymakers belatedly acquiesced to our calls for them to substantially delever these behemoths, the RoE mirage disappeared.

Fast-forward to the present day and our contrarian projection has played out. On a statutory basis, RoEs have slumped by one-third to the high single-digit, or low double-digit, domain. In the 2019 financial year, ANZ and NAB are expected to report statutory RoEs of 9.6 per cent and 9.8 per cent, respectively. CBA’s RoE has dropped from almost 19 per cent in 2014 to 12 per cent today (Westpac sits in the middle at around 11 per cent). Valuations have followed in lock-step with ANZ, NAB and Westpac all trading at circa 1.5 times book value while CBA’s multiple has slumped from 3 times to 2 times book value.

The silver-lining is the much lower leverage and business model risk (as the majors divest offshore exposures and exit non-core activities) comes with a substantial reduction in their risk. This is terrific news for the voiceless and oft-neglected bank stakeholders that supply 95 per cent of their funding, namely depositors and bond holders. And it is not all bad news for the shareholders who provide the remaining 5 per cent of bank funding: if the banks can exploit their enormous scale economies to slash people costs, which account for about 60 per cent of their operating expenses, through automation and transform themselves into higher returning technology businesses, they might one day be able to recover their previous valuation multiples.