This is an article published by Kieran Davies, Chief Macro Strategist, on Livewire recently.

In a world of near-zero interest rates, the stance of monetary policy is now better measured by the size and composition of a central bank’s balance sheet. In Australia’s case, the RBA’s adoption of unconventional monetary policy has seen its balance sheet rapidly increase from 9% of GDP prior to the pandemic to about 17% by the end of last year.

This expansion – which eclipses the 13% peak during the global financial crisis when the RBA was dealing with dysfunctional financial markets – has been driven by: (1) bond purchases required to achieve the RBA’s target for the 3-year bond yield; (2) traditional quantitative easing (QE) with a $100bn round of bond purchases; and (3) cheap term loans to banks via the Term Funding Facility (TFF).

The balance sheet will continue to grow this year as: (1) the RBA undertakes another $100bn round of QE when the current programme finishes in April (as predicted by CCI in January here); and (2) banks draw on remaining c$100bn of funds at the TFF before applications close in June. On our estimation, the balance sheet should approach 30% of GDP, marking the largest share of output since the 1950s, back when the RBA’s predecessor was unwinding its financing of WW2.

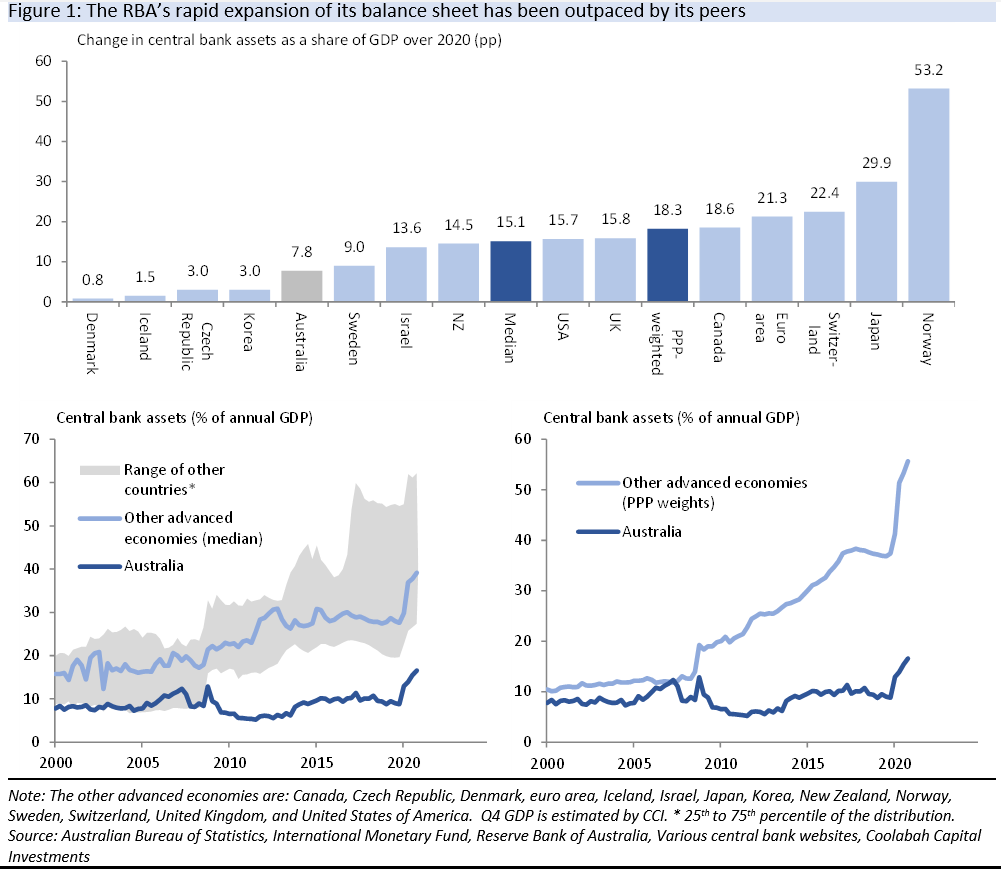

Although this expansion is remarkable by Australian standards, other central banks have been increasing their balance sheet for longer than the RBA and at a more aggressive pace. Such action resulted from other countries exhausting conventional monetary policy sooner than the RBA and a greater willingness among its peers to direct unconventional policy at traditional macroeconomic objectives. On our estimation, the approximately 8pp increase in the RBA’s balance sheet as a share of GDP last year is at the low end of international experience, with a 15pp increase in the median balance sheet of other advanced economies (or 18pp when calculated using PPP weights).

The action of other central banks, which have continued buying bonds this year, matters for the RBA because it places upward pressure on the exchange rate, which the RBA views as critical to the transmission of QE through the economy (i.e., the RBA expects bond purchases to lower the exchange rate by reducing Australian yields compared with other countries). Like the RBA, we think that the initial round of QE had an impact on the bond market and the currency, but this benefit was more than offset by easier monetary policy abroad, as summarised by the relative increase in central bank balance sheets.

Quantifying the impact of easier policy abroad on the exchange rate is difficult. CCI’s initial panel analysis of advanced economies found that a larger central bank balance sheet is associated with a lower real exchange rate, although the results were not robust given it is hard to allow for other influences on currencies. Nonetheless, the actions of other central banks clearly have an impact on the RBA’s policy decisions, with Governor Lowe noting that all his fellow governors recognise that “when one country delivers monetary stimulus and another doesn’t there’s an exchange rate response”.

With other central banks continuing to buy bonds this year, ongoing upward pressure on the exchange rate makes us confident that the RBA will continue to buy bonds when QE2 ends later this year, with CCI forecasting QE3/QE4 will extend unconventional policy into 2022.

Although some market participants are resistant to the idea of further QE, Governor Lowe has said that the RBA “[hasn’t] ruled out further bond purchases after the current programme”, which is not surprising given the formidable challenge the RBA faces in achieving full employment. Indeed, CCI believes the market is underestimating the risk that the RBA actually changes the size of its purchases rather than simply extending the programme into next year.