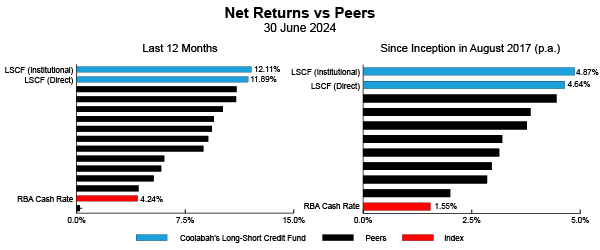

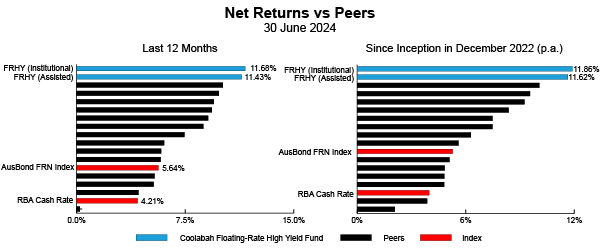

We are delighted to report that several of Coolabah’s market-leading, daily liquidity strategies have topped their Morningstar peer universe over the 12 months to June 2024, specifically:

- Coolabah’s Long-Short Credit Fund ranks number #1 (Institutional) and #2 (Direct) in Morningstar’s Unconstrained Fixed Income Universe over the 12 months to June 2024. It has also been awarded a 5 star quant rating over 5 years. Over this period, it returned between 11.89% (Direct) and 12.11% (Institutional) after fees.

- Coolabah’s Floating-Rate High Yield Fund ranks number #1 (Institutional) and #2 (Assisted) in Morningstar’s Australian Short Term Fixed Interest over the 12 months to June 2024. Over this period, it returned between 11.43% (Assisted) and 11.68% (Institutional) after fees.

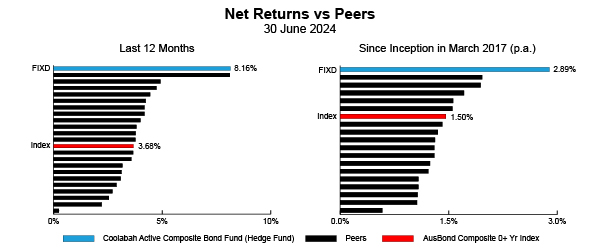

Coolabah’s market-leading, long duration strategy, the Coolabah Active Composite Bond Fund (Hedge Fund) (ETF: FIXD) has outperformed its benchmark, the AusBond Composite Bond Index and key peers since inception and 1, 3, and 5 year period. It ranked number #1 over 5 years in Money Management’s Fixed Interest – Australian Bond Universe. Over the 12 months to 30 June 2024, it returned 8.16% and outperformed the index by 4.48% after fees.

Further information on each strategy can be found below. Please read the Product Disclosure Statement and the Target Market Determination for more information on the associated risks. A copy of these documents can be found below or on our website.

Coolabah Long-Short Credit Strategy

- Aims to actively exploit mispricing’s in global cash and bond markets to generate daily liquidity returns that exceed a target of the RBA cash rate plus 4% to 6% pa after all fees and near-zero interest rate duration risk.

- Provides floating-rate bond exposure with a current average portfolio credit rating of “A+”.

- Has a current running yield of 7.38% p.a. gross of fees.

- Easy access with daily redemption rights.

- The Fund can borrow, use derivatives and short-sell, meaning the Fund may be geared (or leveraged). Leverage can amplify gains and also amplify losses. Please read the PDS for risks.

Key Documents | Direct Investor Class | SLT2562AU

Coolabah Floating-Rate High Yield Strategy

- Focuses on generating higher income than other traditional fixed income investments by investing in a portfolio of investment-grade Australian floating-rate notes with enhanced yields.

- Currently invests in a portfolio of cash securities and floating-rate, Australian bank and insurer issued senior and Tier 2 bonds with an average rating of “A+”.

- Has a current running yield of 8.11% p.a. gross of fees.

- Does not invest in fixed-rate bonds, hybrid securities, equities or property.

- Daily redemption rights and no performance fees.

Key Documents | Assisted Investor Class | ETL5010AU

Coolabah Active Composite Bond Fund (Hedge Fund) (ETF: FIXD)

- A long duration, daily liquidity, active fixed-income strategy that targets beating the AusBond Composite 0+ Yr Index by 1% to 2% p.a. with similar volatility and duration risk.

- Focusses on liquid, investment-grade bonds, with an average credit rating in the A to AA bands, that are tradeable in all environments, including stressed market conditions.

- Has beaten Index and key peers over 1, 3, 5 year and inception periods with superior risk-adjusted returns.

- Over the last 12 months to 30 June 2024, FIXD has returned 8.16%, outperforming the Index by 4.48% after fees. Since its inception in March 2017, FIXD has returned 2.89% p.a., outperforming the Index by 1.39% p.a. after fees.

- Has a current running yield of 6.46% p.a. gross of fees.

- Cannot invest in hybrid securities, equities, property, unrated securities, high yield bonds or sub-prime loans.

- Available as an Active ETF under the ticker FIXD or directly with the Fund Administrator through the APIR Code ETL2716AU.

- The Fund can borrow, use derivatives and short-sell, meaning the Fund may be geared (or leveraged). Leverage can amplify gains and also amplify losses. Please read the PDS for risks.

Key Documents | ETL2716AU & ETF: FIXD

Investment Disclaimer: Returns, yields and portfolio characteristics are shown as of 30 June 2024. Past performance does not assure future returns. All investments carry risks, including that the value of investments may vary, future returns may differ from past returns, and that your capital is not guaranteed. This information has been prepared by Coolabah Capital Investments (Retail) Pty Limited, a wholly owned subsidiary of Coolabah Capital Investments Pty Ltd. It is general information only and is not intended to provide you with financial advice. You should not rely on any information herein in making any investment decisions. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any relance on this information. The Product Disclosure Statement (PDS) for the funds should be considered before deciding whether to acquire or hold units in it. A PDS for these products can be obtained by visiting www.coolabahcapital.com. Neither Coolabah Capital Investments Pty Ltd, Coolabah Capital Investments (Retail) Pty Limited, Equity Trustees Limited nor its respective shareholders, directors and associated businesses assume any liability to investors in connection with any investment in the funds, or guarantees the performance of any obligations to investors, the performance of the funds or any particular rate of return. The repayment of capital is not guaranteed, Investments in the funds are not deposits of any of the above-mentioned parties, nor of any Authorised Deposit-taking Institution. The funds are subject to investment risks, which could include delays in repayment and/or loss of income and capital invested. Past Performance is not an indicator of nor assures any future returns or risks. Coolabah Capital (Retail) Pty Limited (ACN 153 555 867) is an authorised representative (#000414337) of Coolabah Capital Institutional Investments Pty Ltd (AFSL: 482238).

Equity Trustees (AFSL: 240975) is the Responsible Entity for these funds. Equity Trustees Ltd is a subsidiary of EQT Holdings Limited (ACN 607 797 615), a publicly listed company on the Australian Stock Exchange (ASX: EQT).