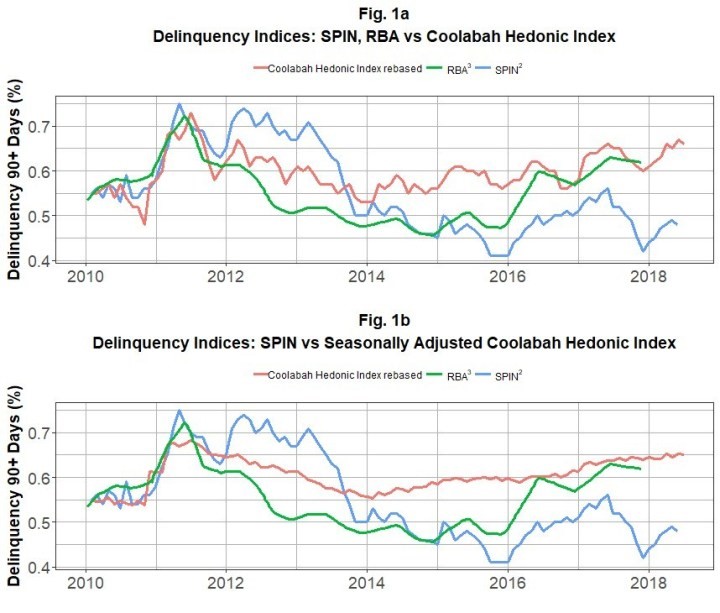

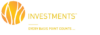

Measuring and monitoring the true level of mortgage delinquencies across an economy is essential for asset pricing and financial system stability. Yet public measures of mortgage default risk almost always use simple averages across pools of individual assets, including balance-sheet loans or indices tracking default risk across portfolios of residential mortgage-backed securities (RMBS). These approaches are, like median house price indices, afflicted by compositional biases that can lead to spurious inferences regarding the direction of default rates. Sources of bias include artificial changes in default rates attributable to: increases in the volume of new loans being written or securitised RMBS added to indices; changes in the proportion of transactions with higher loan-to-value ratios (LVRs); the introduction of less seasoned RMBS transactions with a lower weighted-average loan age; and/or borrower characteristics that have higher probabilities of default (e.g. tilts towards investment borrowers). To address this problem, we have developed the first known hedonic regression-based indices of mortgage default risk that explicitly control for compositional biases through the models’ characteristic-based independent variables. Whereas simple average measures of default rates across securitised loan portfolios have declined in recent years, which suggests that the risk of loss has been declining, our hedonic mortgage default index implies exactly the opposite: that is, compositionally-adjusted default rates have, in fact, been increasing sharply in recent times. Read the full paper here.