At the end of May we prepared this essay on the changing probabilities in Trump’s trade war, which explained that the end-game for many in Washington was, in fact, no deal. The goal was, on the contrary, the imposition of widespread tariffs on all Chinese exports in order to shift US supply chains out of that market, which is now considered an existential national security threat.

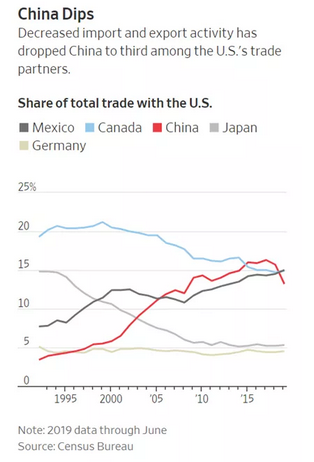

The WSJ reports that the trade war has indeed had this effect, with China slumping from No.1 to No.3 in the rankings of the US’s key trading partners with Mexico and Canada rising in her stead (see chart below).

After a brief thaw in China-US relations over June and July, animosities have resumed in August following Trump’s decision to unilaterally apply a new 10% tariff on the remaining $300bn of Chinese exports that were not being taxed, which now seems sure to come into effect on 1 September.

China duly responded by blocking all US agricultural imports and allowing a modest depreciation in her otherwise pegged Yuan exchange rate, which Trump and the US treasury promptly slammed as “currency manipulation”, potentially presaging even more punitive tariffs.

Ironically, the consensus had been that China has been maintaining an artificially elevated exchange rate to thwart capital flight and avoid incurring the wrath of its US critics (ie, the Yuan would be a lot lower were it not for Chinese interventions).

Markets are now grappling with the juxtaposition of interest rate cuts from the Fed and the ECB in September, and the prospect of far-reaching ECB QE, balanced against the renewed headwinds to global growth precipitated by this ongoing dispute.