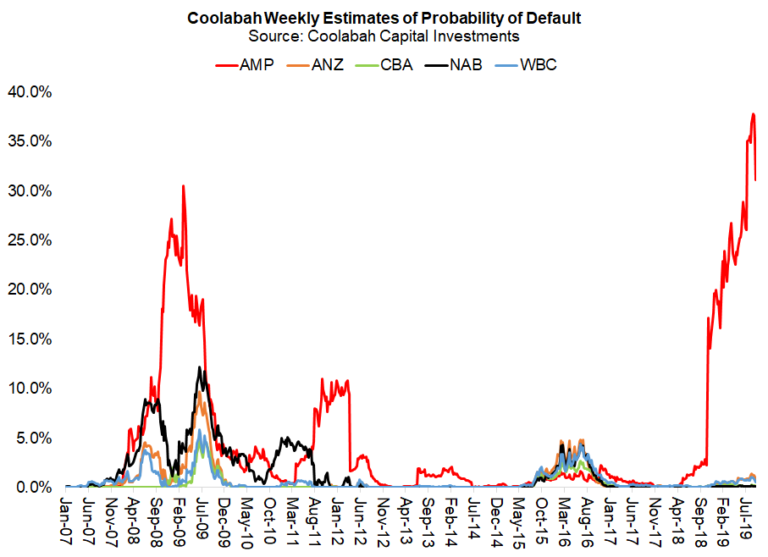

Today I argue that in response to the 2008 crisis central banks and treasuries have thrown the baby out with the bathwater. Unable to tolerate the pain associated with capitalism’s most important attribute, “creative destruction” – or the cathartic process by which markets punish bad businesses and reward good ones – government agencies decided that they would take control of private market prices when the signals embedded in them wrought too much disruption. They did this by buying all manner of bonds to manipulate the short- and long-term risk-free “discount rate” that investors use to price the present value of the cash flows produced by all assets. And when that was not enough, governments bought direct stakes in companies, including many banks, and equities more broadly. Conventional capitalism that has powered prosperity for more than half a century by respecting market signals no longer exists. While it may not be socialism, it is certainly statism. I also discuss our research that shows that AMP’s default risks have sky-rocketed beyond 2008 levels (see chart). Read the full column here or AFR subs can click here. Extract below:

“And since central banks and treasuries have got into the business of directly managing private market prices, they have never been able to get out. It is way too tempting to try to control your destiny rather than leaving it to the whims of capricious investors. Just ask Xi Jinping.

Ironically given the current global trade turmoil, the West and China have never had more in common in terms of the economic policies they espouse.

After the European Central Bank committed to launching a new round of asset purchases (aka “quantitative easing”, or QE), the Fed has been forced into the same thing. The RBA is not far behind.

In the last week, the Fed has spent $US128 billion ($A188 billion) expanding its balance sheet to soothe markets. And it continues to reinvest the proceeds of the trillions of dollars of assets it bought during the crisis into purchases of bonds rather than allowing its balance sheet to shrink.

Bank of America Merrill Lynch estimates that the Fed will have to buy about $US400 billion in additional government bonds over the next year to ensure that the private sector, heaven forbid, is not lumbered with this responsibility.

Somebody has to fund President Trump’s record budget deficits, and doing so has sucked capital away from short-term financing markets, which has radically increased the volatility of the interest rates in this crucial sector.

In one auction this week, the cost of borrowing overnight in the US spiked from 2.25 per cent to 10 per cent, the first time this has happened since 2008.

Profligate fiscal policy is an emerging post-crisis thematic. When your central bank can print as much money as it wants and fund all your debt at crazy-cheap levels – as the Japanese and, to a lesser extent, the Americans do – there is no practical limit on how big your budget deficits can get.

You are insulating yourself from any market disciplines because your central bank (rather than investors) is setting your cost of capital at artificially low levels.

We live in a world where all asset prices are fake and unnaturally inflated. Even in Australia.

House prices are appreciating again not because of some underlying imbalance between demand and supply, but because the RBA is being compelled to respond to lowest-common-denominator global policies that have created a beggar-thy-neighbour currency war.

In an Australian government bond fund today you earn almost no interest after fees.

The more profound question is what could possibly reverse this new global statism? The only tractable explanation I can conceive of is inflation.