Coolabah Capital UK Ltd (CCUKL, FCA Reference Number: 933016) is authorised and regulated by the Financial Conduct Authority (FCA) as part of a framework encompassing the Prudential sourcebook for MiFID Investment Firms (“MIFIDPRU”). This section outlines the prudential requirements that apply to CCUKL for the FYE June 2024.

Chapter 8 of MIFIDPRU (MIFIDPRU 8) governs public disclosure rules and guidance with which the Firm must comply as part of those prudential requirements. CCUKL is classified under MIFIDPRU as a Non-SNI FCA regulated firm. MIFIDPRU 8 requires CCUKL to disclose information with respect to these factors:

- Risk management objectives and policies.

- Governance arrangements.

- Own funds.

- Own funds requirements.

- Remuneration policy and practices.

The disclosure for CCUKL is prepared at least annually as a solo FCA regulated firm. The disclosed information is proportionate to CCUKL’s size, scope, nature and complexities of CCUKL’s activities.

All figures are as at the latest financial year-end per the Audited Annual Report and Financial Statements filed with the FCA and with Companies House.

Significant Changes Since Prior Disclosure

Compared to the prior reporting period, there have been no significant changes to the composition or main components of CCUKL’s own funds.

Business Review and Strategy

The Firm was authorised by the FCA in December 2020. The Firm is an investment adviser to an intra-group entity called CCII which is a professional counterparty. Please refer to the Audited Annual Report and Financial filed with Companies House for details on how the Investment Advisory Agreement between CCII and CCUKL operates.

Risk Management Objectives and Policies

This section describes CCUKL’s risk management objectives and policies for the categories of risk addressed by the requirements of the Firm in the following areas:

- Own funds;

- Concentration risk;

- Liquidity;

- Own Funds Requirement.

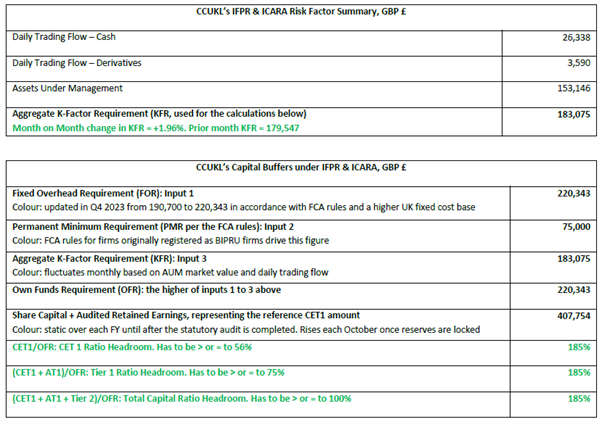

CCUKL is required to maintain own funds that are at least equal to the Firm’s own funds requirement. The own funds requirement is the higher of the Firm’s inputs 1 to 3 in the table included below represented by CCUKL’s Capital Buffers. The approach adopted by the Firm to manage the risk of breach of the Firm’s Own Funds Requirement (OFR) is to maintain an own funds surplus above the OFR: 185% in the table below. In the event that the Firm’s own funds drop to an amount equal to 110% of the Firm’s own funds requirement, the Firm will notify the Group Management and Board Risk and Compliance Committees to seek permission to inject more funds and equity.

In conjunction with these Committees, the UK Board of Directors (CCUKL’s UK Governing Body) will immediately consider measures to increase the Firm’s own funds buffer, including injecting more funds and equity. The Firm will also notify the FCA if the matter is not rectified immediately by such an injection of capital.

Concentration Risk

The Firm monitors and controls its concentration risk using sound administrative and accounting procedures and robust internal control mechanisms. Cash is diversified across several UK banks and Money Market Funds.

The potential for harm associated with CCUKL’s business strategy, based on the Firm’s concentration risk, is low.

The Investors are typically institutional investors investing for the medium to long term such as pension funds, insurance companies and other professional investors provide a diversified stream of revenue.

Liquidity

The Firm is required to maintain sufficient liquidity to ensure that there is no significant risk that its liabilities cannot be met as they fall due and to ensure that it has appropriate (liquid) resources in the event of a stress scenario.

The potential for harm associated with CCUKL’s business strategy, based on the Firm’s basic liquid assets requirement, is low. The Firm retains an amount it considers suitable for providing sufficient liquidity to meet the working capital requirements under various conditions. CCUKL has always had sufficient liquidity within the business to meet its obligations and there are low threats to this given the cash deposits it holds.

The Finance Team under the CFO is responsible for the day-to-day monitoring and management of the Firm’s cash position. Cash flow forecasts are prepared on a regular basis and project both fee income and expenditures of the Firm, including known future events such as fee reductions from lower Fund AUM, new hires, capital purchases, and system enhancements.

The Finance Team manages liquidity levels to ensure cash held in specific bank accounts, not used for operating expenses, are greater than the basic liquid assets requirement as set out under MiFIDPRU 6. This is reviewed and cash levels updated upon any changes to the basic liquid asset requirement figure.

Risk Management Structure

The Firm has in place arrangements in relation to all aspects of its business. These arrangements are grouped into five broad areas:

Organisation and Management

The Firm maintains a clear organisational structure which is organised to maximise independence of function and to avoid internal conflicts. Should an actual or potential conflict be identified, this would be documented and mitigated where possible.

People and Responsibilities

Individuals have clearly defined roles and responsibilities. Openness and communication is encouraged across all functions, particularly in respect of any suspected breach of the Firm’s legal, ethical, and regulatory obligations. There is also an appraisal process in place for all staff which includes mid-year and annual reviews with 360-degree feedback.

Business Processes

Business risk is managed through the appointment of skilled senior personnel together with management oversight arrangements and a combination of formal and informal checks and balances. The Firm maintains a close working relationship with its clients, prime brokers and administrators and certain other key advisers such as auditors, tax advisors, and lawyers.

Management Information and Reporting

The importance of information as a governance tool is recognised by the UK Governing Body, which consists of its Board of Directors. The Firm has adopted risk management and management information systems in place that are designed to ensure that senior management have the required information that they need for reporting.

Compliance Monitoring and Reporting

The Firm has sought to embed a culture of compliance throughout the business through a combination of education and training for staff and clarity of responsibility for management. In addition, there are detailed compliance policies covering factors on an individual and firm wide basis, which include but are not limited to best execution, trade allocation, trade errors, conflicts of interest, market abuse prevention, anti-money laundering and financial crime prevention, personal account dealing, and gifts and entertainment. All staff are required to attest that they have read and complied with these on a regular basis through a quarterly distribution cycle. There is a risk-based monitoring plan in place which is an on-going process to monitor compliance with existing procedures and to ensure regulatory changes are addressed as they arise.

Governance Arrangements – Overview

Governance Framework and Enterprise Risk

Due to the nature, size, and complexity of the Firm, CCUKL has an independent risk oversight function which is part of the Chief Risk Officer’s portfolio of responsibilities; the CRO also serves as the UK Compliance Executive. The UK Governing Body is responsible for the management of operational risk within the Firm and the individual responsibilities of its members are clearly defined per FCA functions. The Group Management and Board Risk and Compliance Committees provide an overall governance framework.

As an Equal Employment Opportunity employer, the Firm does not discriminate on the basis of race, religion, colour, sex, age, sexual orientation, national origin, marital status, disability, status with regard to any other legally protected category.

Own Funds, Composition of Regulatory Own Funds, Audited Financial Statements, Members’ capital and audited reserves and TIER 1 CAPITAL

Please refer to the IFPR summaries above and the published audited accounts filed at UK Companies House.

Own Funds Requirements

CCUKL is required to at all times maintain own funds that are at least equal to the Firm’s own funds requirement. The own funds requirement is the minimum requirement of capital the Firm is required to hold, taken as the higher of the PMR and FOR. Please refer to the IFPR summaries above.

CCUKL is also required to comply with Overall Financial Adequacy Rule (“OFAR”). This is an obligation on CCUKL to hold own funds and liquid assets which are adequate, both as to their amount and quality, to ensure that:

- The Firm is able to remain financially viable throughout the economic cycle, with the ability to address any material potential harm that may result from its ongoing activities;

- The Firm’s business can be wound down in an orderly manner, minimising harm to consumers or to other market participants;

- Where CCUKL determines that the FOR is insufficient to mitigate the risk of a disorderly wind-down, the Firm must maintain “additional own funds required for winding down, above the FOR, that are deemed necessary to mitigate the risks of a disorderly wind-down;

- Similarly, where the Firm determines that the KFR is insufficient to mitigate the risk of harm from ongoing operations, the Firm must maintain an amount of own funds required for ongoing operations, above the KFR, that is deemed sufficient to ensure the viability of the Firm throughout economic cycles.

The Firm’s OFR is the higher of:

- The Firm’s PMR;

- The sum of the Firm’s FOR and its additional own funds required for winding down;

- The sum of the Firm’s KFR and its additional own funds required for ongoing operations.

This is the amount of own funds required to maintain at any given time to comply with the OFAR.

To determine the Firm’s own funds threshold requirement, the ICARA identifies and measures the risk of harm faced by the Firm and considers these risks in light of its ongoing operations and also from a wind-down planning perspective.

The Firm then determines the degree to which systems and controls alone mitigate the risk of harm and the risk of a disorderly wind-down, and thereby deduces the appropriate amount of additional own funds required to cover the residual risk.

On at least an annual basis, this process is detailed, presented, and consented to by:

- the Group Management and Board Risk and Compliance Committees, and

- the UK Governing Body.

Remuneration Policy and Practices

Overview

As a Non-SNI MIFIDPRU Investment Firm, CCUKL is subject to the basic and standard requirements of the MIFIDPRU Remuneration Code (as laid down in Chapter 19G of the Senior management arrangements, Systems and Controls sourcebook in the FCA Handbook (“SYSC”)). The purpose of the remuneration requirements is to:

- Promote effective risk management in the long-term interests of the Firm and its clients;

- Ensure alignment between risk and individual reward;

- Support positive behaviours and healthy firm cultures;

- Discourage behaviours that can lead to misconduct and poor customer outcomes.

The objective of CCUKL’s remuneration policies and practices is to establish, implement and maintain a culture that is consistent with, and promotes, sound and effective risk management and does not encourage risk-taking which is inconsistent with the risk profile of the Firm and the services that it provides to its client.

In addition, CCUKL recognises that remuneration is a key component in how the Firm attracts, motivates, and retains quality staff and sustains consistently adequate levels of performance, productivity, and results. As such, the Firm’s remuneration philosophy is also grounded in the belief that its people are the most important asset and provide its greatest competitive advantage.

Nature of the Firm’s Remuneration Policy and Practices

Remuneration at CCUKL is made up of fixed and variable components. The fixed component is set in line with market competitiveness at a level to attract and retain skilled staff. Variable remuneration is paid on a discretionary basis and takes into consideration the Firm’s financial performance as well as the financial performance of each business unit, and the financial and non-financial performance of the individual in contributing to the Firm’s success. All staff members are eligible to receive variable remuneration.

Governance and Oversight

The Group Remuneration Committee in conjunction with the UK Governing Body is responsible for setting and overseeing the implementation of CCUKL’s remuneration policy and practices. In order to fulfil their responsibilities, the Committee and Body:

- Exercise competent and independent judgment on remuneration policies and practices, including the incentives for managing risk, capital, and liquidity;

- Ensure that the remuneration policy and practices consider the public interest and the long-term interests of investors;

- Ensure that the overall remuneration policy is consistent with the business strategy, objectives, values, and interests of the Firm and of its clients;

- Ensure that the remuneration policy and practices are reviewed regularly.

Material Risk Takers

CCUKL is required to identify its material risk takers – those members of staff whose professional activities have a material impact on the risk profile of the Firm (and of the assets that the Firm manages). The types of staff that have been identified as material risk takers at CCUKL are:

- SM&CR members of the UK Governing Body in executing its management function with mind and management in the UK;

- Those with managerial responsibilities for the activities of a control function;

- Those that are responsible for managing a material risk within the Firm;

- Those with managerial responsibilities for the prevention of money laundering and terrorist financing.

Quantitative Remuneration Disclosure

The audited financial statements filed with Companies House UK contain the remuneration paid to staff in the financial-year. For these purposes, staff is defined broadly, and includes, for example, employees of the Firm itself, members, employees of other entities in the group, employees of joint service companies, and secondees for the period ended 30 June 2024:

- Senior Management: 3.

- Total Number of Material Risk Takers: 2.

- Remuneration Awarded: disclosed to the FCA and in notes to the accounts.

- Guaranteed Variable Remuneration: NIL.

- Severance Payments: NIL.

- Highest Severance Payment Awarded to an Individual: NIL.

MIFIDPRU investment firms are typically required to split the quantitative data in the above table, where relevant, into categories for senior management and other material risk takers. However, the regulator allows firms to aggregate or altogether omit the information to be disclosed for senior management and other material risk takers, where splitting the information between these two categories would lead to the disclosure of information about only one or two individuals.

Published: December 2024